World News – JPMorgan Chase “failed miserably” as an institution, a U.S. attorney said Tuesday in announcing a record settlement over the company’s role as Bernard Madoff’s bank. It will cost JPMorgan Chase nearly $2.6 billion total to settle allegations that it turned a blind eye to Madoff’s epic Ponzi scheme. No individuals from the bank will be penalized, however, and putting behind one of its biggest scandals will cost the bank less than two weeks’ revenue.

Chase was Madoff’s primary bank for years, and it structured and sold investment vehicles tied to his purported returns.

Chase was Madoff’s primary bank for years, and it structured and sold investment vehicles tied to his purported returns.

In a multipronged settlement unveiled Tuesday, JPMorgan will admit that it violated the Bank Secrecy Act by failing to file a regulatory report in 2008 — when it suspected Madoff’s returns were fake — and by not using sufficient compliance systems.

In a so-called deferred prosecution agreement, U.S. Attorney for the Southern District of New York Preet Bharara won’t pursue the charges and will dismiss the case after two years as long as the bank implements a series of reforms and pays a $1.7 billion fine — the largest ever for a Bank Secrecy Act case.

“Today’s charges have been filed because in this regard, JPMorgan, as an institution, failed and failed miserably,” Bharara said. “In part because of that failure, for decades, Bernie Madoff was able to launder billions in Ponzi proceeds — essentially, through a single set of accounts at JPMorgan.”

JPMorgan will pay $350 million to settle a parallel civil case by the Office of the Comptroller of the Currency.

Finally, the bank will pay $524 million to settle private litigation, including a multibillion-dollar lawsuit filed in late 2010 by bankruptcy Trustee Irving Picard alleging that the bank was “thoroughly complicit” in Madoff’s fraud, which the bank denies.

“We do not believe that any JPMorgan Chase employee knowingly assisted Madoff’s Ponzi scheme,” JPMorgan spokesman Joseph Evangelisti said in a statement.

Nonetheless, the bank is promising to implement “best in class” compliance systems.

“We recognize we could have done a better job pulling together various pieces of information and concerns about Madoff from different parts of the bank over time,” according to the statement.

The deferred prosecution agreement calls the bank’s conduct “willful,” noting that in 2007 a senior bank official urged colleagues to look into “well-known” allegations that Madoff was running a Ponzi scheme.

In October 2008, the bank did alert regulators in Great Britain that Madoff’s returns seemed “too good to be true” but did not file a similar report in the U.S., violating federal law.

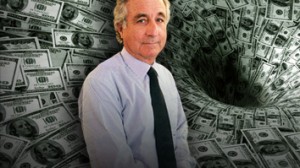

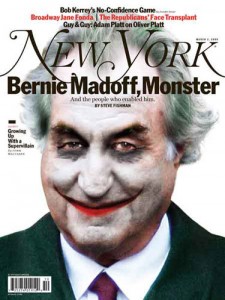

Madoff, who is serving a 150-year prison sentence for operating a $65 billion Ponzi scheme, used Chase as his primary bank for more than two decades. He admitted to fabricating stock trades and putting his investors’ money into a single account at the bank.

JPMorgan Chase was in regulators’ crosshairs almost as soon as Madoff confessed in 2008, but they have been unable to bring a case until now.

JPMorgan has been aggressively seeking to settle a number of government investigations. Last year it agreed to a record $13 billion settlement with the Justice Department over alleged abuses in the mortgage market before the 2008 financial crisis.

—By CNBC’s Scott Cohn